Corporate PPAs – Powering into the Future

Traditionally electricity consumers purchased power from utility companies. However, an alternative model, the “Corporate PPA”, is emerging and has recently been used in Ireland. A Corporate PPA is a long-term arrangement under which a generator, usually of renewable electricity, sells its output to a large electricity consumer, such as a data centre. These arrangements provide additional revenues for the generator, and the consumer benefits from locking in price certainty and an assurance that the power it consumes is renewable.

The move towards Corporate PPAs has been driven by a combination of factors including:

- increased electricity demand, in particular, in certain tech and IT sectors;

- a desire/requirement of certain large consumers to decarbonise; and

- price volatility in electricity markets.

Structures

Corporate PPAs can take a number of forms. Internationally, the main forms to emerge are sleeved PPAs and synthetic (or financial) PPAs. In Ireland, there is an additional possibility of using a supplier lite structure.

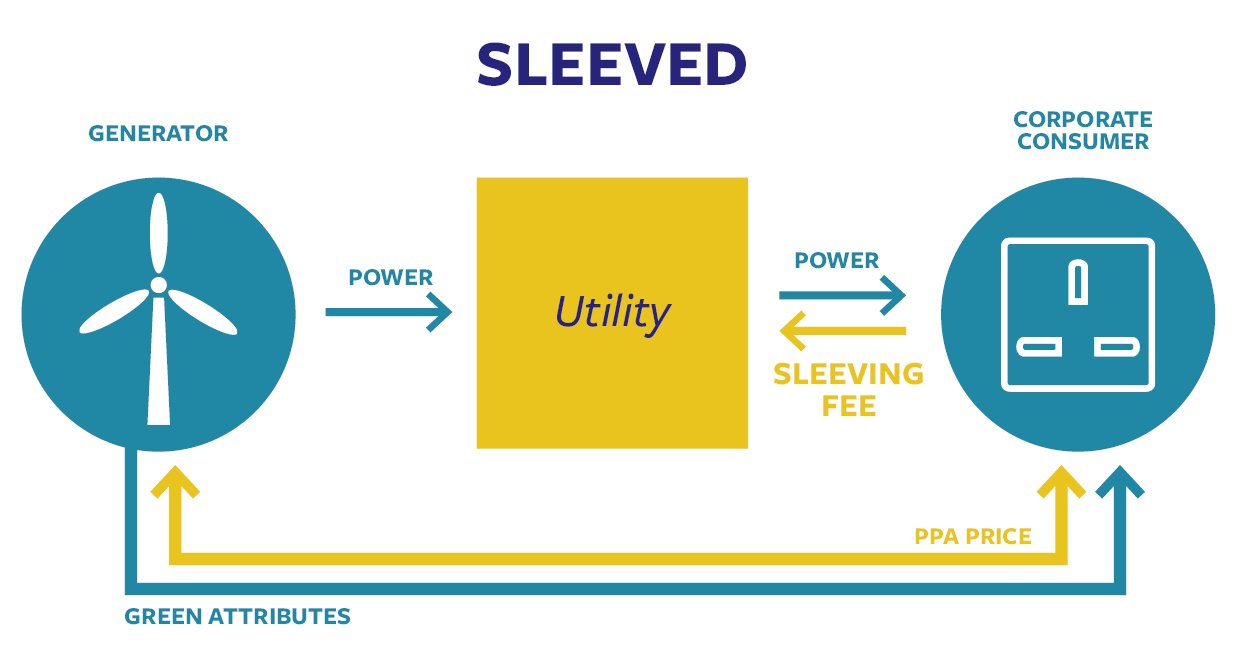

Sleeved

Sleeved PPAs, also referred to as “back to back” PPAs, are physical arrangements under which power may be sold by the generator to the consumer via power purchase agreements with a utility. The utility will enter into PPAs on mirror image commercial terms (subject to REFIT related terms) to buy the power from the generator and sell it to the consumer. Typically the consumer will pay a margin or a “sleeving fee” to the utility for transacting the power through the pool.

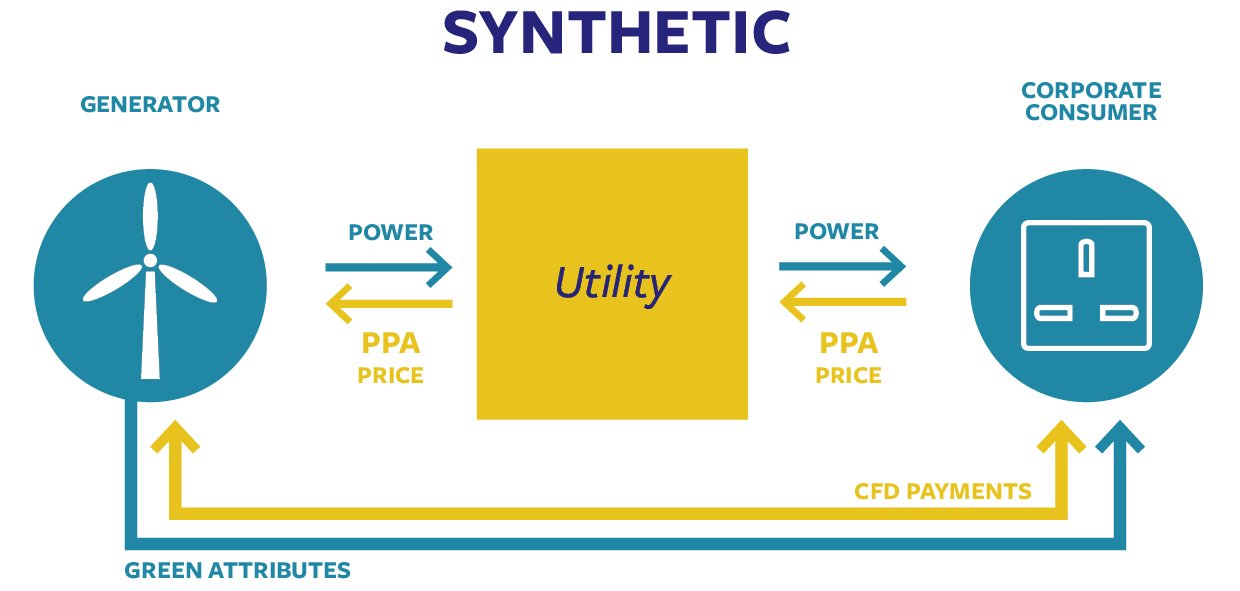

Synthetic

A synthetic PPA is a contract for difference between the generator and the consumer. The generator has a traditional offtake contract, and the consumer has a traditional supply contract, with a utility, but, through the difference payments under the synthetic PPA, the parties lock in the fixed strike price for the sale/purchase of power. Such arrangements may also transfer any green rights associated with the power to the consumer. These arrangements have certain advantages for the consumer over sleeved arrangements including that:

- they are easily scalable;

- they can be highly flexible; and

- being solely financial contracts, the consumer does not have to consider any technical or regulatory details of the generator’s project.

The main disadvantage is that financial regulation implications must be considered.

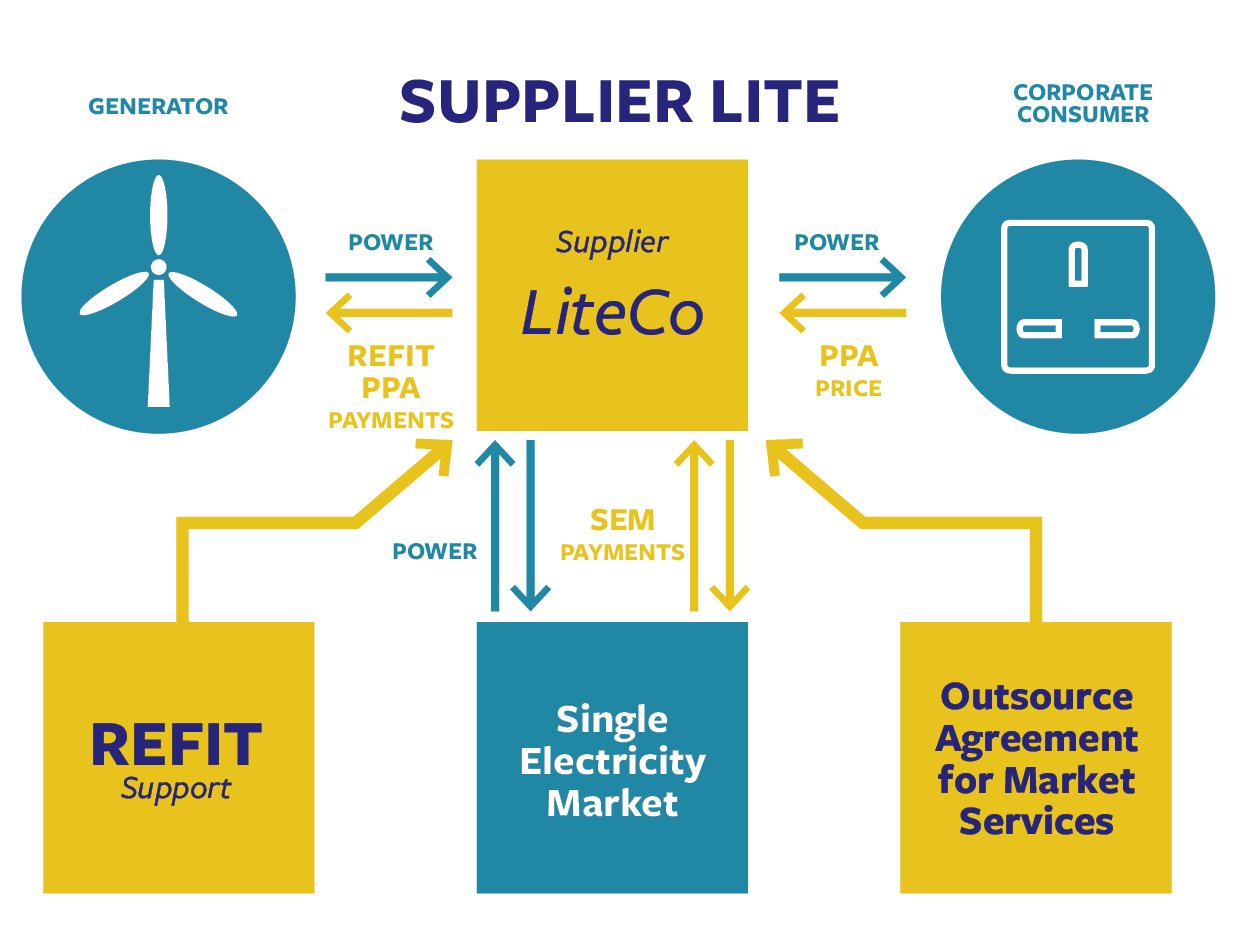

Supplier Lite

A model used in Ireland – largely due to the structures of the REFIT schemes - is Supplier Lite. Under this structure, the consumer establishes its own licensed supply company (the “Supplier Lite”) which enters into a REFIT supported power purchase agreement with the generator. The Supplier Lite passes the output through the SEM pool and sells it to the consumer under an electricity supply agreement. The Supplier Lite typically outsources all of its operations to a trading and markets expert (often referred to as the Supplier Lite service provider). The advantages of such arrangements for the consumer include the following:

- the Supplier Lite is credited as having supplied the consumer with the relevant quantity of renewable electricity in fuel mix disclosures;

- the parties may share the REFIT balancing payment in such proportions as they agree; and

- the consumer has a natural hedge against high wholesale market prices.

The Future

The increasing number of large electricity consumers such as data centres, the market uncertainty associated with the introduction of the Integrated Single Electricity Market (“I-SEM”) and the drive towards greater renewables are leading to increased interest in Corporate PPAs. The Department of Communications, Climate Action and Environment (“DCCAE”) has yet to finalise the changes to the REFIT schemes required due to the introduction of I-SEM. Such changes, including the treatment of I-SEM balancing risk, are likely to influence the future structure of Corporate PPAs for REFIT projects.

Recently DCCAE published a consultation paper on the design of a proposed new Renewable Energy Support Scheme for Ireland (the “RESS”). The scheme is likely to take the form of a contract for differences to be awarded following a technology neutral auction. Unlike the REFIT schemes, it is likely that the RESS will support solar projects which again will appeal to the Corporate PPA market.

Our Experience

McCann FitzGerald has advised on the most significant renewables transactions that have taken place in the Irish market and on a variety of innovative PPA solutions including developing early supplier lite services arrangements. Most recently we advised ElectroRoute, a dynamic energy trading and services company headquartered in Dublin, on its involvement in an arrangement pursuant to which a subsidiary of Microsoft Corp. will purchase 100% of the electrical output from GE’s new, 37MW Tullahennal wind farm in County Kerry, Ireland.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below