Irish Merger Control 2022 – Your 2-Minute Update

1. By the Numbers

2 – How many deals the CCPC effectively blocked this year: 1 by outright veto; 1 after the parties abandoned their deal on receipt of written objections from the CCPC.

2006 – When the agency last successfully blocked a deal. Never before has CCPC intervention prevented 2 deals in a single year.

4 – The number of filings rejected by the CCPC, requiring full re-notification, for incomplete responses to RFIs.

8 – How many weeks an average Phase 1 clearance took, excluding ‘no issue’ deals assessed under the CCPC’s simplified procedure.

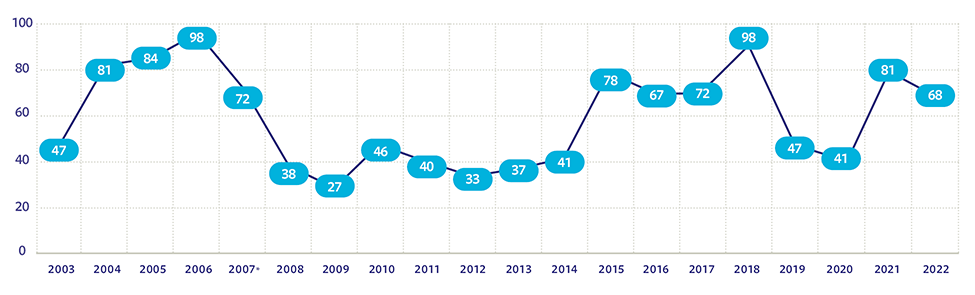

Number of Deals Notified 2003-2022:

2. Increased CCPC Deal Scrutiny & Scepticism

For the first time in over a decade, and only the third time in 20 years of Irish merger control, the CCPC prohibited a deal outright. Following a 12-month review, the CCPC concluded that acquisition by leading Irish drug wholesaler and pharmacy group, Uniphar, of a pharmacy solutions business, Navi, would substantially lessen competition. According to the CCPC, the deal would unduly restrict competition on Irish markets for provision of “buying group services” and “common management and branding services.”

A second deal, involving two regional heating oil and diesel distributors, was abandoned following CCPC issuance of a written assessment (Irish equivalent to a Statement of Objections) after a 9-month merger review. A significant uptick in the number of filings rejected for incomplete information reflects the CCPC’s heightened scrutiny of deals.

3. More Demanding Remedies Required to Clear Deals

A more robust approach to merger control enforcement is equally clear from the remedies required by the CCPC to clear deals. In Bank of Ireland’s €8 billion acquisition of rival KBC, a 4-to-3 bank deal, the CCPC required Bank of Ireland to commit €1 billion funding to non-bank lenders at a stipulated price.

4. New & Greater Regulatory Risk for Deal-Makers

In addition to increased scrutiny of below-threshold deals following 2022 changes to Irish merger control rules, deal-makers need to be aware of potential filing requirements under new EU foreign subsidies rules, Irish foreign direct investment rules, and the EU’s DMA.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below