Irish Merger Control 2024 – Key Takeaways

In this briefing, we highlight the key themes from Irish merger control in 2024 and look forward at the emerging developments in 2025, including the recent introduction of Ireland’s new FDI screening regime.

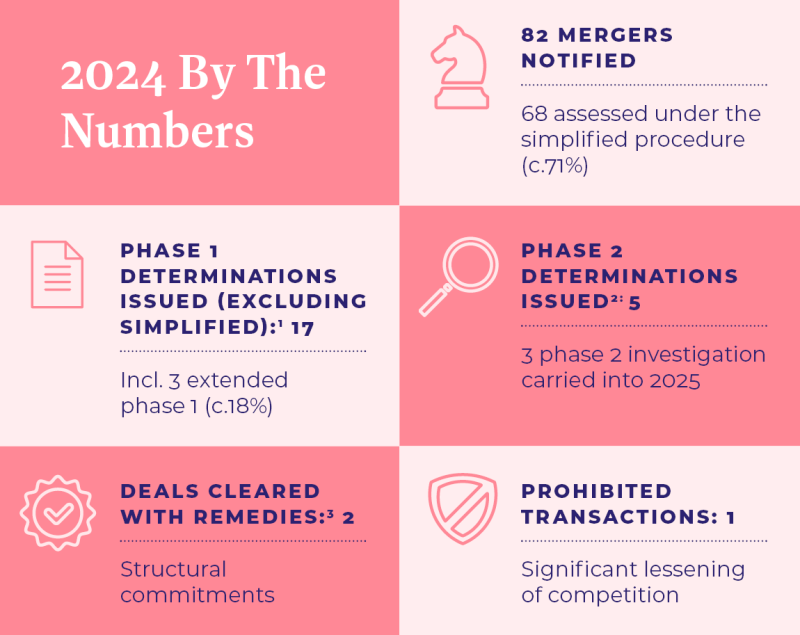

1. Significant Increase in the Number of Notified Deals

2024 saw a marked increase in the number of deals notified to the CCPC. 82 transactions were notified to the CCPC, which represents a 21% increase on the 68 notified in 2023 and the highest number of deals reviewed by the CCPC since 2018. The significant increase in notifications coincides with increased M&A activity globally, which has been attributed to reductions in inflation, interest rates and capital costs in 2024. The three sectors with the most deals notified to the CCPC in 2024 were Professional Services (15), Energy and Utilities (8) and Healthcare (7).

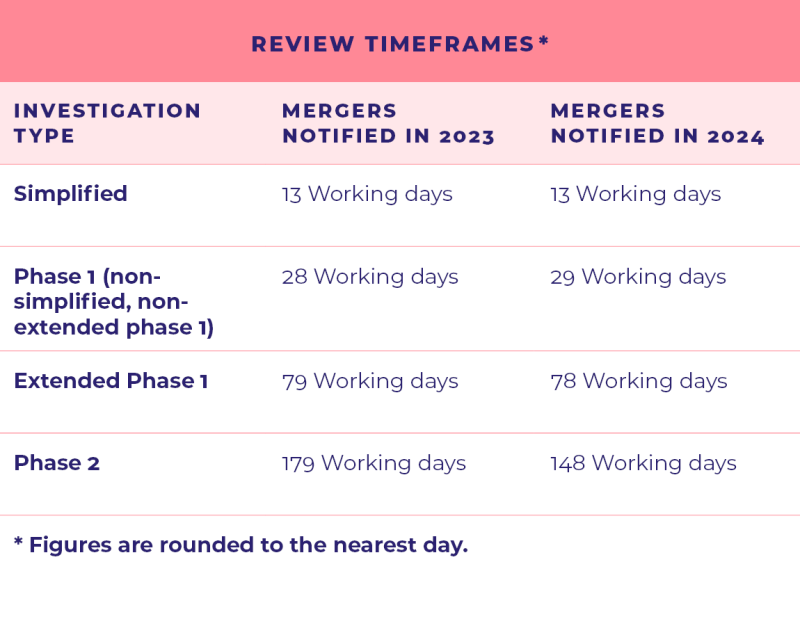

2. Review Timeframes – Comparing 2023 and 2024

The timeframes for the CCPC’s review of notifications were generally in line with the timeframes achieved in 2023, with the exception of Phase 2 reviews, where the CCPC’s average review time saw a notable decrease due to the short review period in case M/24/011 – LloydsPharmacy/McCabes Pharmacy.

3. Increased Scrutiny for Complex Deals Persists

For the second time in two years, and only the fourth time in 20 years of Irish merger control, the CCPC prohibited a deal outright. Following a 12-month review, the CCPC concluded that acquisition by the operator of Dublin airport, daa, of a car park site near Dublin airport, would substantially lessen competition. According to the CCPC, the deal would have substantially lessened competition in car parking serving Dublin Airport, as daa would have owned over 90% of the public car parking spaces if the deal had been allowed.

Of the 82 deals notified in 2024, 5 were subject to a Phase 2 investigation: M/24/011 – LloydsPharmacy/McCabes Pharmacy; M/24/014 – Coca-Cola/BDS Vending; M/24/018 – Phoenix/Cellnex; M/24/026 – Formpress Publishing/D&D Media and M/24/042 – Circle K/Pelco Holdings Ltd.

4. Highest Percentage of Transactions Assessed under the Simplified Regime

The CCPC’s simplified procedure for deals involving no - or limited-overlap continues to be a resounding success. Of the 82 deals notified in 2024, 58 (c.71%) were assessed under the simplified regime. This is up from 52% in 2023, and represents the highest percentage of deals assessed under the simplified regime in a single year since the regime came into force in 2020. Clearance times under the simplified regime have remained consistent since 2020, with deals typically being cleared within 13 working days of notification.

5. Phase 2 Investigations more likely in Ireland than at EU level

There has been a steady increase in the percentage of deals notified under the CCPC’s standard notification procedure, being subject to a full Phase 2 investigation, from 10% in 2022 and 15% in 2023, to 21% in 2024. This contrasts with deals notified to the European Commission under its standard procedure in 2024, of which only 7% were subject to a Phase 2 investigation.

The trend for increased simplified mergers was consistent in both Ireland and the EU, with 90% of the 392 mergers notified to the European Commission being notified under its simplified procedure.

6. Significant Increase in the Number of Private Equity Deals

The number of notified transactions involving PE has increased almost two-fold from 2023. Notably, there were five transactions notified in the Irish veterinary sector in 2024. In the UK, the CMA has opened a market investigation into the high level of concentration in the UK veterinary sector. While the CCPC has yet to prohibit any transactions or require remedies from PE acquirers in the Irish veterinary sector, we may see greater CCPC scrutiny in 2025 if the volume of deals in this sector persists.

Things to look out for in 2025

New FDI Screening Regime

The Screening of Third Country Transactions Act 2023 (the “FDI Act”) entered into force on 6 January 2025. The FDI Act introduces a standstill obligation on parties to transactions that involve investment from outside of the EEA and Switzerland, relating to Irish targets and assets in five sensitive sectors (critical infrastructure, critical technologies and dual use items, the supply of critical inputs, access to sensitive information, and the freedom and pluralism of the media). This will have significant implication for transaction timetables for affected deals.

Parties contemplating entering into a transaction in 2025 with an Irish nexus should consult their legal advisors early in the transaction planning process, for advice as to whether the transaction could be in scope. For further information on Ireland’s new FDI Screening Regime, please see our briefing (here).

Important Reforms on the Way

In September 2024, the CCPC opened a consultation process on its “Merger Guidelines”. The Merger Guidelines set out and elaborate on key areas considered by the of the CCPC in assessing whether or not a merger, acquisition or joint venture will lead to a substantial lessening of competition. The purpose of this consultation process is to obtain stakeholder feedback - with a view to publishing revised merger guidelines in the near future. The consultation process closed in November 2024 and the CCPC is now assessing stakeholder submissions. In 2025, we expect the CCPC to publish revised merger guidelines for consultation, and perhaps even adoption in the latter half of the year.

Also contributed to by Seán Kehoe

- This includes four deals notified in 2023 (M/23/064 – Sysco Foods/Ready Chef; M/23/065 - Phey Topco/Transmore; M/23/066 - SSBL/Viaplay; and M/23/067 – Macquarie/Viatel

- This includes two deals that were notified in 2023 (M/23/060- Kilsaran / Certain Assets of Kilmurray and M/23/068 – McMullan Bros./Naas Fuels Limited)

- This includes one deal that was notified in 2023 (M/23/065 - Phey Topco/Transmore)

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below