Money, Money, Money: Electronic Money vs Electronic Money Tokens

As the financial landscape continues to develop at pace and the way we do business changes, there has been increased focus on digital money and cryptocurrencies.

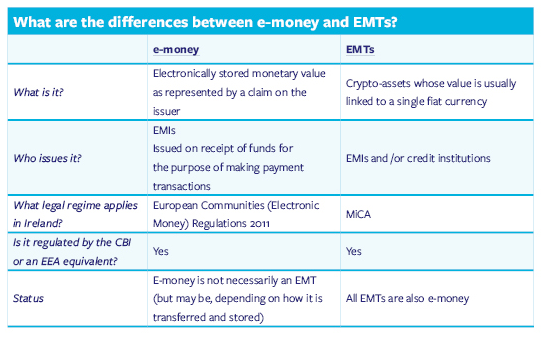

Cryptocurrency is a digital form of an asset or a digital representation of value. As digital money comes in many different forms, it is important to understand the different forms, in particular the distinction between electronic money and electronic money tokens.

What is Electronic Money?

Electronic money (“e-money”) is electronically (including magnetically) stored monetary value as represented by a claim on the issuer of the e-money which:

- is issued on receipt of funds for the purpose of making payment transactions;

- is accepted by a person other than the issuer; and

- is not excluded from the definition of e-money by Regulation 5 of the European Communities (Electronic Money) Regulations 2011 (the “EMI Regulations”).

Regulation 5 of the EMI Regulations provides that the EMI Regulations do not apply to monetary value stored on specific payment instruments that can be used only in a limited way, provided that such instruments meet certain conditions. Similarly, the EMI Regulations do not apply to monetary value that is used to make certain payment transactions by a provider of electronic communications networks or services provided in addition to electronic communications services for a subscriber to the network or service.

An electronic money institution (“EMI”) is an undertaking which has been granted authorisation to issue e-money in accordance with the EMI Regulations. Such an authorisation is required in order to be able to issue e-money in the European Economic Area (“EEA”).

What are E-Money Tokens?

E-money tokens (“EMTs”) are a type of crypto-asset and its value is linked to a single fiat currency (such as the Euro or US Dollar).1 A crypto-asset is a digital representation of a value or of a right that is able to be transferred and stored electronically using distributed ledger technology or similar technology. A distributed ledger is an information repository that keeps records of transactions and that is shared across, and synchronised between, a set of distributed ledger technology network nodes using a consensus mechanism.

What obligations are imposed on the issuers of EMTs?

The Markets in Crypto-Assets Regulation EU 2023/1114 (“MiCA”) applies strict conditions to the issuance of EMTs. EMTs may only be issued by a credit institution or an EMI that is regulated by the Central Bank of Ireland (“CBI”) or an equivalent EEA regulator. MiCA entered into force in June 2023 and will become generally applicable on 30 December 2024.

Under MiCA, the issuers of EMTs must comply with specified prudential, organisational and conduct of business requirements. Issuers must issue EMTs at par value and grant holders redemption rights at par value and cannot grant interest on EMTs.

Additionally, under MiCA, issuers of EMTs must publish a white paper with specified information for the public. The information to be included in the white paper includes information about:

- the issuer (such as its name, address, date of registration, parent company (if applicable), and potential conflicts of interest);

- the EMT (such as its name, descriptions, and all natural and legal persons who designed and developed the EMT);

- the offer being made to the public (such as the total number of units to be offered to the public);

- the rights and obligations attaching to the EMT (such as the right of redemption, and complaints handling procedures);

- the EMT’s underlying technology; and

- the risks associated with the EMT and its issuer and any mitigation measures that will be taken. Significant EMTs will be subject to higher capital requirements and oversight by the European Banking Authority.

Authorisation Requirements

To issue e-money, an entity needs to be authorised as an EMI. To issue EMTs, an entity needs to be authorised as a credit institution or as an EMI. Therefore, any entity seeking to issue e-money or EMTs should consider obtaining authorisation as an EMI.

McCann Fitzgerald LLP is a premier law firm in Ireland and advises on the full range of legal, tax and compliance activities undertaken by EMIs in Ireland. We have substantial experience in successfully guiding applicants through the regulatory authorisation process and in helping them to comply with their legal obligations, once established. To learn more about the authorisation process, please see our briefing here. If you are considering setting up an EMI authorised under Irish legislation, please contact us for further information as to how we can help.

- Article 3(1)(7) of Markets in Crypto-Assets Regulation EU 2023/1114 states an “‘electronic money token’ or ‘e-money token’ means a type of crypto-asset that purports to maintain a stable value by referencing the value of one official currency”.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below