EMIR Trade Reporting: What Does the Central Bank of Ireland Expect?

Under EMIR, a counterparty to derivatives trades (a “Counterparty”) must report details of those trades to certain trade repositories (“TRs”) in compliance with requirements set out in EMIR and related implementing and technical regulations and guidance. Last year, the Central Bank of Ireland – Ireland’s national competent authority for EMIR purposes - undertook a series of data quality checks on reported EMIR data for a cross section of Counterparties to ascertain compliance with those requirements. On 20 February 2019, it provided its feedback on those checks.

A Counterparty should regularly review the completeness and accuracy of its reports to TRs, to ensure that all trade submissions to TRs are complete and accurate. The Central Bank’s findings focus on four issues:

- delegated reporting;

- the completeness and accuracy of trade reporting;

- the Legal Entity Identifier (“LEI”); and

- the Unique Trade Identifier (“UTI”),

and it sets out a number of recommendations in relation to each of these issues, as set out in the tables below.

The Central Bank noted that, in light of its findings, Counterparties should include compliance with the EMIR reporting requirement as a standard agenda item for Board meetings. A Counterparty that has delegated its reporting arrangements should also ensure that its delegate is aware of the Central Bank’s feedback; the Counterparty and the delegate will need to review their reporting arrangements to ensure that full account is taken of the Central Bank’s feedback.

The Central Bank previously addressed each of the four issues identified above in feedback on the EMIR Regulatory Return on 30 September 2016. While this new feedback is more detailed than the 2016 feedback, it repeats many of the same concerns. While noting that the quality of data reported to TRs is improving, the Central Bank also reminds Counterparties that a failure to comply with EMIR constitutes a prescribed contravention and may result in supervisory or enforcement action.

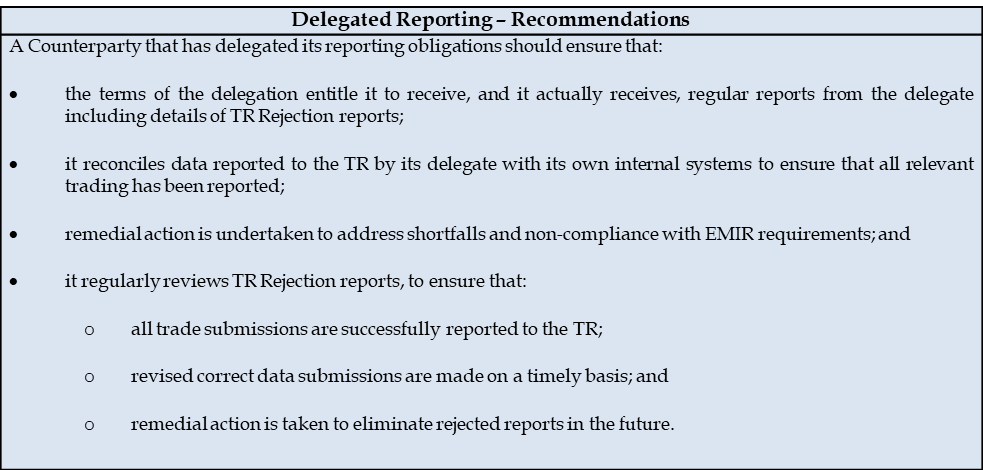

1. Delegated Reporting

A significant number of Counterparties delegate EMIR trade reporting either to the other Counterparty to the transaction or to a third party. In such instances, the delegating Counterparty remains responsible for compliance with the EMIR reporting requirements and must take appropriate steps to ensure compliance with those requirements, including with regard to the rejection reports generated by TRs where the data provided does not comply with the reporting standards. The Central Bank had identified instances where such steps were not taken by the delegating Counterparty.

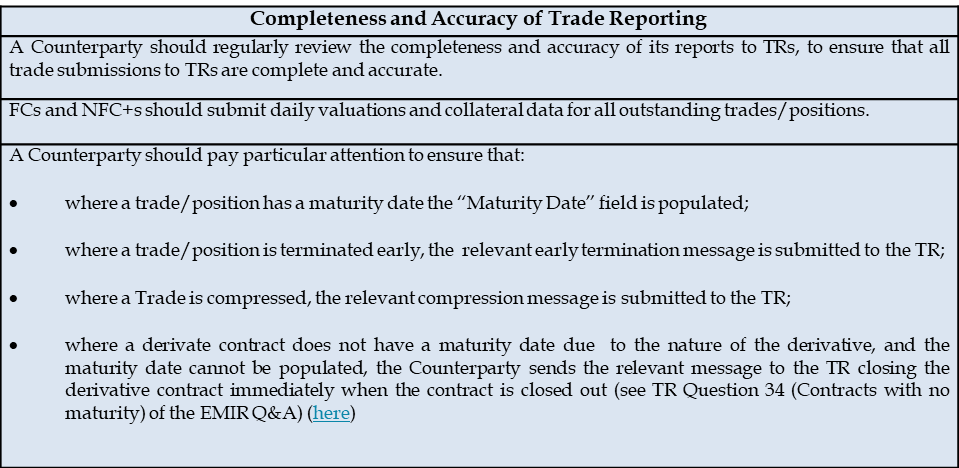

2. Completeness and Accuracy of Trade Reporting

The Central Bank has observed a number of recurring issues with respect to the completeness and accuracy of trade reports, including instances where financial counterparties (“FCs”) and non-financial counterparties above the EMIR clearing threshold (“NFC+s”) have failed to report daily valuation updates and failed to report collateral. It had also identified a significant number of expired derivative trades/positions on the reports at TRs showing all outstanding positions at a point in time.

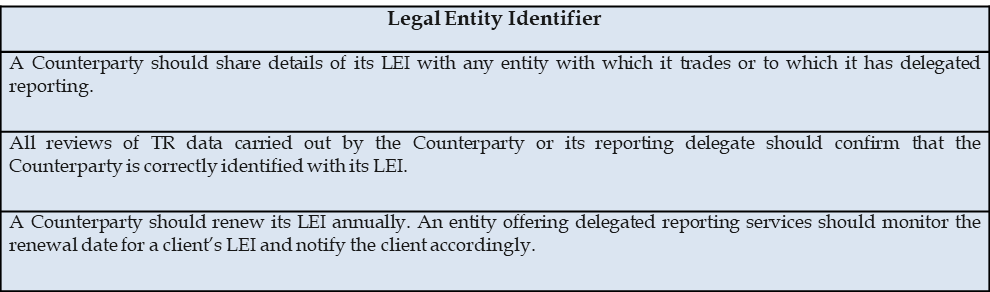

3. Legal Entity Identifier (LEI)

Trade reports must include an LEI to identify a Counterparty which is a legal entity. An LEI is a 20 character alphanumeric code that is used to uniquely identify parties to a financial transaction (see our related briefing here).

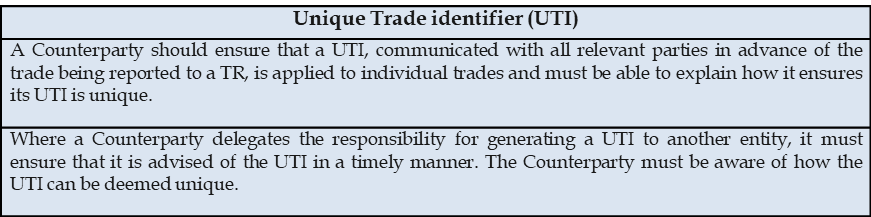

4. Unique Trade identifier (UTI)

Pursuant to the EMIR reporting requirement, each derivative contract must be known and identified by all relevant parties by a Unique Trade Identifier (UTI). If there is no UTI in place, a unique code should be generated and agreed between the Counterparties to the contract.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below