EMIR Update: The Clearing Obligation and Risk Mitigation Techniques for Non-Centrally Cleared OTC Derivatives

The last two weeks have seen two significant developments regarding the EMIR clearing obligation as well as further developments regarding the delayed adoption of draft regulatory technical standards on risk mitigation techniques for non-centrally cleared over-the-counter (OTC) derivatives under EMIR.

On 20 July 2016 Delegated Regulation 2016/1178 applying the clearing obligation to fixed-to-float interest rate swaps (“IRS”) and forward rate agreements denominated in Norwegian Krone (“NOK”), Polish Zloty (“PLN”) and Swedish Krona (“SEK”) was published in the EU’s Official Journal (“OJ”). This is the third Delegated Regulation on the clearing obligation which has been published in the OJ. On 21 July 2016 the Commission published a corrigendum to the Delegated Regulation.

Some days earlier, on 13 July 2016, the European Securities and Markets Authority (“ESMA”) issued a new consultation in which it is proposing to amend the application of the clearing obligation for financial counterparties with a limited volume of activity.

On 22 July 2016 the Joint Committee of the European Supervisory Authorities (“ESAs”) published a letter (dated 18 July 2016) from the European Commission responding to concerns they have raised about the delayed adoption of draft regulatory technical standards (“RTS”) on risk mitigation techniques for non-centrally cleared OTC derivatives under EMIR.

Third Delegated Regulation

EMIR requires certain over-the-counter (OTC) derivatives to be centrally cleared. It also mandates the European Commission to adopt Delegated Regulations stipulating the classes of OTC derivatives to which the central clearing obligation is to apply, as well as the dates from which that obligation will take effect. The Delegated Regulations are based on draft RTS developed by ESMA.

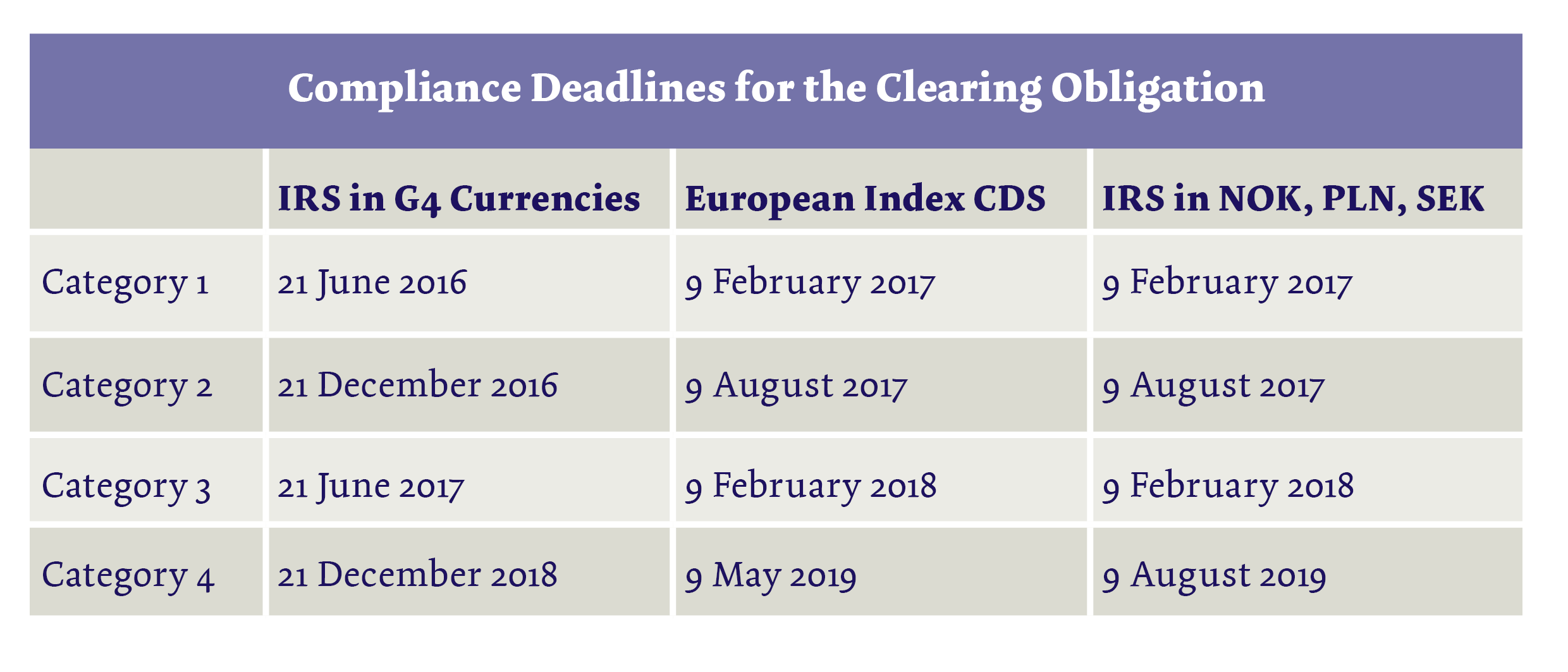

The first and second Delegated Regulations on the clearing obligations were published, respectively, on 1 December 2015 and 19 April 2016. The first Delegated Regulation 2015/2205 applies the clearing obligation to certain OTC IRS denominated in the G4 currencies (euro, pounds sterling, Japanese yen and US dollars). The second Delegated Regulation 2016/592 applies the clearing obligation to Untranched iTraxx Index CDS (Main, EUR, 5Y) and Untranched iTraxx Index CDS (Crossover, EUR, 5Y). See our related briefings here and here.

The third Delegated Regulation mirrors the first two Delegated Regulations with regard to the categorisation of counterparties and the use of phase-in periods, namely:

- 9 February 2017 - clearing members of a recognised or authorised central counterparty for at least one of the classes of OTC derivatives covered by Annex 1 of the Delegated Regulation or of Delegated Regulation 2015/2205 (“Category 1”);

- 9 August 2017 - financial counterparties as defined in EMIR (“FCs”), and alternative investment funds as defined in the Alternative Investment Fund Managers Directive (“AIFs”) that are nonfinancial counterparties as defined in EMIR (“NFCs”), which belong to a group whose aggregate month-end average of outstanding gross notional amount of non-centrally cleared derivatives is above EUR 8 billion for January, February and March 2016 (“Category 2”);

- 9 February 2018 - FCs and AIFs that are NFCs not falling within categories 1 or 2 (“Category 3”); and

- 9 August 2019 NFCs not falling within another category (“Category 4”).

The frontloading obligation will only apply to Category 1 and Category 2 entities and it will take effect on 9 October 2016 for both. The third Delegated Regulation includes a three-year phase-in mechanism to deal with intragroup transactions, and also allows funds to calculate the aggregate average outstanding gross notional amount of noncentrally cleared derivatives individually at a fund level for calculating the threshold used to determine the clearing category of such entity. See our earlier briefing here.

You may access the third Delegated Regulation here.

The Consultation

According to ESMA, certain smaller financial counterparties with a limited volume of activity may be facing difficulties in getting access to central counterparty clearing. Consequently, ESMA is seeking information for the purpose of further identifying and quantifying these difficulties. It is also proposing to delay the phase-in period for counterparties included in Category 3 of each of the three Delegated Regulations by adding two years to the current compliance deadlines. The consultation closes on 5 September. You may access the consultation here.

Risk Mitigation Techniques for Noncentrally Cleared Derivatives

The ESAs published the draft RTS on riskmanagement procedures for non-centrally cleared OTC derivatives in March 2016 with the phase in of mandatory collateral exchange and margin requirements expected to start from 1 September 2016. See our related briefing here.

On 9 June 2016 the European Commission announced that the adoption of the draft RTS would be delayed. This was followed by a letter from the ESAs on 30 June 2016 expressing their concern at the proposed delay and requesting that any proposed delay be kept as short as possible (here). Among other things, the letter argues that:

- the calendar for implementing the requirements on risk mitigation techniques for non-centrally cleared derivatives was agreed at international level and it is important to honour this agreement as the delay raises substantial uncertainty regarding the overall implementation;

- a delay in the endorsement of the RTS could raise a number of cross-border issues. Among other issues relating to the interaction of the EU regime with other equivalent regimes, a large number of FCs and some NFC groups should start exchanging variation margin from 1 March 2017. This timeline is relevant for the entire industry and a delay may require a re-negotiation of existing agreements; and

- while the firms captured by the 1 September date are small in number, they represent a significant amount of the market and are a substantial source of systemic risk. The delay in the implementation time-line might incentivise global banks to use their European operations to carry out OTC derivatives transactions. Only part of these transactions might be covered by other jurisdictions’ extraterritorial provisions, contrary to the European Commission’s suggestion that such entities would be captured by other jurisdictions’ regimes.

In its response, the European Commission states that the delay in adopting the RTS is caused by the need to complete legal reviews to ensure that the adopted rules provide the necessary clarity and certainty. It confirms that it will endeavour to track the international time-lines as closely as possible but cannot confirm what the amended timeline will look like. The response is available here.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below